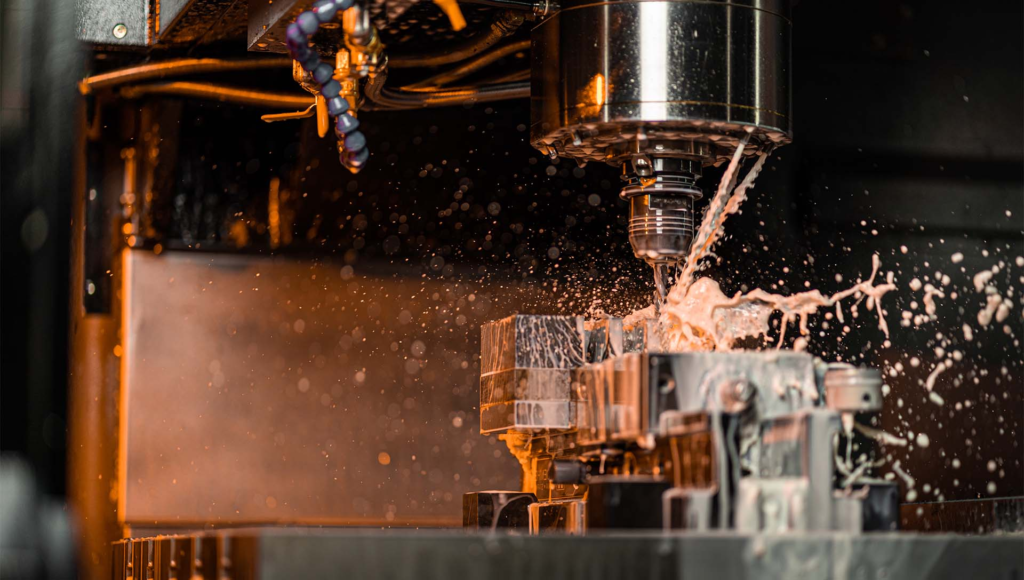

Selecting the right CNC machining supplier has a direct impact on part quality, cost stability, delivery timelines, and long-term production reliability. For engineering buyers, this decision goes far beyond comparing hourly rates or advertised machine lists. A supplier that cannot consistently meet tolerance, material, or process requirements can introduce quality risks, schedule delays, and hidden costs that only appear after production begins.

Selecting a CNC Plastic Machining Supplier

Many sourcing issues arise when suppliers are chosen based only on low pricing or broad capacity claims without deeper technical evaluation. Missed tolerances, inconsistent finishes, and unreliable delivery are common outcomes of this approach. This article breaks down the key criteria engineering buyers should evaluate before approving a CNC machining supplier for prototypes, production programs, or long-term sourcing partnerships.

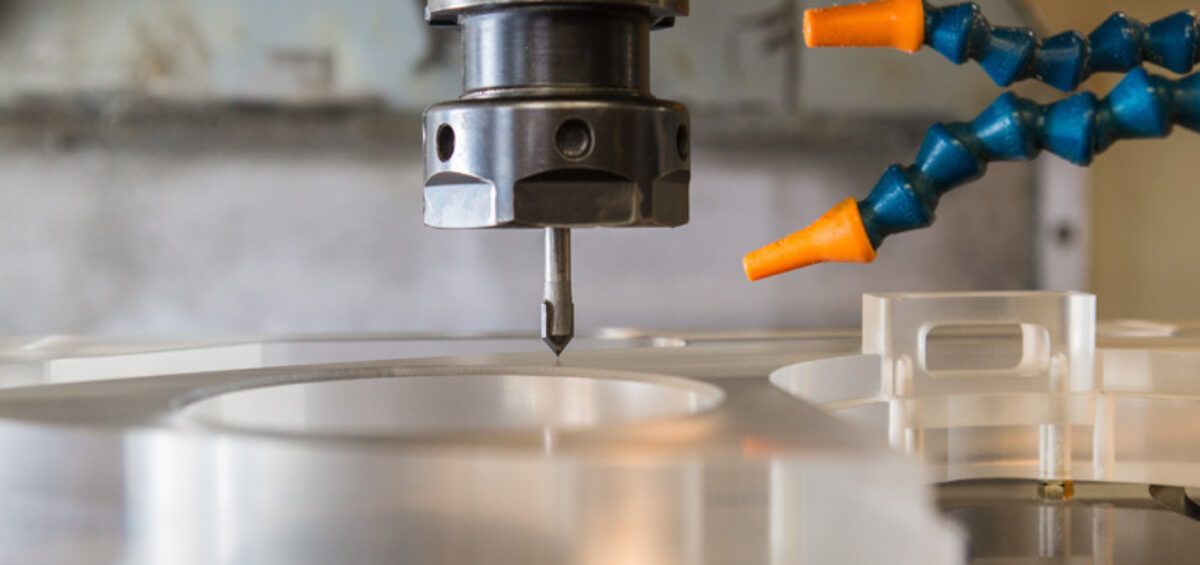

Machine Capabilities and Technical Fit

Not every CNC machining supplier is technically suited for every part, even if they advertise a wide range of capabilities. Machine availability alone does not guarantee that a shop can produce a specific component reliably, repeatedly, and at the required quality level. Engineering buyers need to assess whether the supplier’s equipment, setup practices, and technical limits align with the actual demands of the part, not just its general category.

A strong technical fit reduces risk early in the sourcing process. It minimizes trial and error, avoids unnecessary process compromises, and supports stable production once volumes increase. This evaluation starts with understanding the scope and condition of the supplier’s machining equipment, followed by their material experience and tolerance control in real production environments.

Scope of Machining Equipment

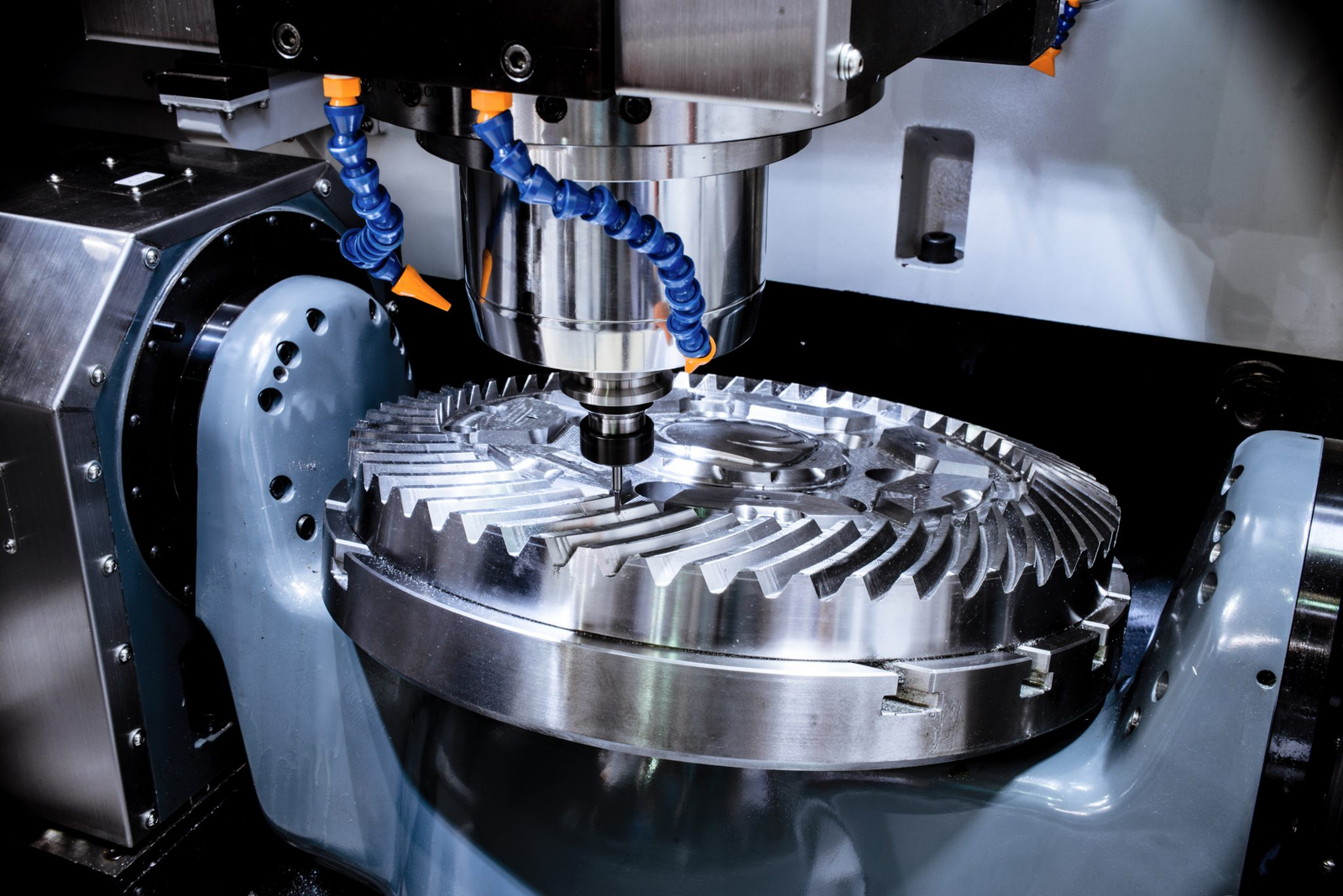

The type and configuration of CNC machines directly influence what a supplier can manufacture efficiently and accurately. A shop equipped only with basic 3-axis mills may not be suitable for parts requiring complex geometries, multi-sided machining, or tight positional relationships between features.

Engineering buyers should confirm whether the supplier operates:

- 3-axis milling machines for simple prismatic parts and flat features

- 4-axis or 5-axis machines for complex contours, compound angles, and reduced setup counts

- CNC turning centers for rotational parts

- Mill-turn machines for parts requiring both milling and turning operations in one setup

Beyond machine type, factors such as spindle power, machine rigidity, and axis travel limits affect surface finish quality and dimensional consistency. Machines operating near their mechanical limits often struggle with vibration, tool deflection, and inconsistent results, especially in harder materials or deep cutting operations.

Material Experience

Material capability is not just about whether a shop can source a specific alloy or plastic. It reflects how well the supplier understands machining behavior, tool selection, and process control for that material. Experience with aluminum does not automatically translate to competence in stainless steel, titanium, or high-performance polymers.

Suppliers with proven material experience are better equipped to manage:

- Tool wear rates and tool life optimization

- Heat generation and thermal distortion

- Chatter control during aggressive or deep cuts

- Surface finish consistency across batches

For engineering buyers, asking about past projects with similar materials helps validate whether the supplier can handle the machining challenges without excessive scrap, rework, or process delays.

Tolerance and Geometry Capability

Published tolerance ranges often look impressive, but what matters is what the supplier can hold consistently in production. Buyers should focus on realistic, repeatable tolerances rather than theoretical machine limits achieved under ideal conditions.

Critical geometry challenges include thin walls, deep pockets, tight internal radii, and complex profiles that require stable tooling and precise process control. Suppliers should be able to explain where tolerances are easily achievable, where they become cost drivers, and where design adjustments may be necessary. This level of clarity signals technical maturity and helps prevent downstream quality issues.

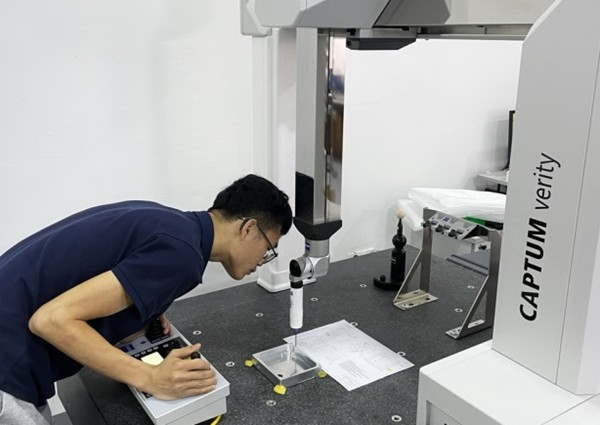

Quality Control Systems and Inspection Methods

Machining accuracy alone does not guarantee part quality. Without a structured quality control system, even capable machines can produce inconsistent results over time. Engineering buyers should evaluate how a supplier verifies dimensions, controls variation, and responds when results fall outside specification. A disciplined inspection process is often the difference between a supplier that performs well in trials and one that remains reliable in production.

Quality Control in Manufacturing

Quality systems should be built into daily operations rather than treated as a final checkpoint. This includes appropriate inspection equipment, documented inspection routines, and clear procedures for managing non-conforming parts. Each element plays a role in protecting part integrity and production schedules.

Inspection Equipment and Measurement Accuracy

Inspection capability must match or exceed the tolerance requirements of the part. A supplier that relies only on basic calipers and micrometers may struggle to verify complex geometry or tight positional tolerances with confidence.

Well-equipped shops typically use a combination of:

- Coordinate measuring machines for dimensional and positional verification

- Optical comparators for profile and edge inspection

- Surface roughness testers to confirm finish requirements

- Calibrated gauges and fixtures for repeat measurements

Engineering buyers should confirm that inspection equipment is regularly calibrated and that measurement resolution is appropriate. Measurement systems should be more accurate than the tolerances being checked; otherwise, inspection data loses reliability.

Process Control and Documentation

Effective quality control extends beyond final inspection. In-process checks help detect issues early, before scrap accumulates or entire batches are affected. First article inspection is particularly important when launching new parts, new materials, or revised drawings.

Suppliers should be able to demonstrate:

- Defined inspection points during machining

- First article inspection reports tied to drawings

- Final inspection records for shipped parts

- Documented inspection plans linked to part risk

Clear documentation supports traceability and gives engineering buyers confidence that quality is controlled systematically rather than reactively.

Non-Conformance Handling

Even in controlled processes, deviations can occur. What separates reliable suppliers from risky ones is how they respond to non-conformances. Buyers should understand how defects are identified, isolated, and corrected without disrupting production flow.

Strong suppliers typically follow a structured approach that includes root cause analysis, corrective action implementation, and verification of effectiveness. Continuous improvement practices reduce repeat issues and demonstrate that the supplier treats quality problems as system failures rather than isolated mistakes.

Certifications, Standards, and Compliance

Certifications and compliance frameworks offer valuable insight into how a CNC machining supplier manages quality, risk, and consistency. While certifications do not replace technical evaluation, they indicate whether a supplier operates with defined procedures, documented controls, and accountability across production. For engineering buyers, these signals become increasingly important as parts move from prototypes into regulated or high-volume environments.

The key is relevance. Certifications must align with the type of parts being sourced, the industries served, and the level of risk involved. A certificate that falls outside the actual manufacturing scope provides little practical value and can create a false sense of security.

Quality Management Certifications

ISO 9001 is the most common baseline certification in CNC machining. It establishes structured requirements for process control, document management, corrective actions, and continual improvement. For many industrial components, ISO 9001 combined with proven machining capability is sufficient.

Certain applications demand stricter, industry-specific standards. Engineering buyers should assess when higher-level certifications are necessary, such as:

- AS9100 for aerospace and aviation components

- IATF 16949 for automotive production programs

- ISO 13485 for medical device manufacturing

It is important to confirm that the certification scope covers the actual machining, inspection, and secondary processes used for the supplied parts, not just administrative functions.

Material Traceability and Compliance

Material traceability protects both engineering and quality teams when issues arise in the field or during audits. Suppliers should be able to demonstrate a clear linkage between raw material and finished parts.

Strong traceability practices include:

- Material test reports for each batch or heat

- Heat number or lot tracking through production

- Documented material storage and segregation procedures

Depending on the end application, additional compliance may be required. Regulatory frameworks such as RoHS or REACH often apply to electronics, consumer products, and certain industrial markets. Buyers should verify that suppliers understand and support these obligations without relying on assumptions.

Audit Readiness

Audit readiness reflects how consistently a supplier follows its stated processes. Suppliers that are prepared for audits typically maintain organized records, stable procedures, and clear accountability across departments.

Indicators of strong audit readiness include:

- Willingness to support customer or third-party audits

- Accessible quality records and inspection reports

- Clear ownership of corrective and preventive actions

For engineering buyers, working with audit-ready suppliers reduces qualification effort, speeds up approvals, and supports long-term sourcing strategies with fewer disruptions.

Lead Time, Capacity Planning, and Delivery Reliability

Lead time commitments only have value when they are supported by realistic capacity planning and disciplined production control. Engineering buyers often encounter suppliers who promise aggressive delivery schedules but lack the internal systems to sustain them once multiple jobs are in progress. Missed deliveries create downstream disruptions, especially when machined parts sit on the critical path of assembly or testing.

Evaluating delivery reliability requires looking beyond quoted lead times. Buyers should assess how suppliers schedule work, manage machine loading, and respond to changes in demand without sacrificing quality or consistency.

Production Scheduling and Load Management

A supplier’s ability to meet delivery dates depends heavily on how well production is scheduled and balanced. Shops operating near full capacity with no buffer are more vulnerable to machine downtime, staffing gaps, and priority conflicts.

Key indicators of sound load management include:

- Defined job scheduling systems rather than informal planning

- Visibility into machine utilization and work in progress

- Cross-trained operators to reduce dependency on individuals

Overbooked shops often compensate by rushing setups or reducing inspection, which increases quality risk. Engineering buyers should ask how delivery promises are protected when urgent jobs or schedule changes arise.

Prototype vs Production Lead Times

Prototype lead times are often shorter because volumes are low and flexibility is higher. Production timelines introduce additional variables such as tooling readiness, inspection throughput, and repeatability across batches.

Suppliers should clearly differentiate between:

- One-off or prototype lead times

- Low-volume production runs

- Ongoing or full-scale production programs

Buyers should also understand how suppliers scale production while maintaining process control. Rapid growth without adequate planning can strain machines, people, and quality systems.

Supply Chain Resilience

Delivery reliability also depends on factors outside the machining cell. Material shortages, tooling delays, and equipment failures can all affect lead time if contingency plans are not in place.

Resilient suppliers typically demonstrate:

- Reliable material sourcing with approved vendors

- Standard tooling availability or in-house tool management

- Backup machines or alternative process routes for critical parts

Engineering buyers benefit from suppliers who anticipate disruptions and communicate early, rather than reacting after schedules are already compromised.

Transparency, Communication, and Long-Term Partnership

Technical capability and capacity mean little without clear communication and operational transparency. For engineering buyers, the quality of interaction with a CNC machining supplier often determines whether issues are resolved early or escalate into cost and schedule problems. Transparent suppliers create alignment across engineering, quality, and procurement teams, which becomes essential in long-term sourcing relationships.

Strong communication practices also reflect how a supplier views the relationship. Suppliers focused only on short-term transactions tend to limit information sharing, while long-term partners invest in clarity, feedback, and shared problem-solving.

Quoting Accuracy and Cost Breakdown

A reliable quotation provides insight into how well a supplier understands the part and its manufacturing requirements. Quotes that are overly aggressive or vague often signal underestimation or hidden assumptions that surface later as price changes or delivery delays.

Clear and professional quotations typically include:

- Material type and grade assumptions

- Estimated machining time and setup considerations

- Tooling, fixturing, and finishing costs were applicable

- Defined lead time and validity period

Engineering buyers should be cautious of pricing that lacks detail, as it increases the risk of cost instability once production begins.

Engineering Support and Feedback

Suppliers that offer engineering input add value beyond machining. Early feedback on manufacturability helps identify design risks, cost drivers, and tolerance conflicts before parts reach the shop floor.

Effective engineering support includes:

- DFM suggests that it balances cost and performance

- Clarification questions on drawings and specifications

- Proactive communication when issues are identified during machining

This level of engagement reduces rework, shortens iteration cycles, and supports smoother transitions from prototype to production.

Data Sharing and Reporting

Ongoing visibility into production status and quality data builds confidence over time. Suppliers that share information consistently allow buyers to plan better and respond quickly when conditions change.

Useful data sharing practices include:

- Inspection reports tied to part revisions

- Progress updates for active orders

- Controlled handling of drawing and revision changes

For engineering buyers, transparency is not about oversight. It is about establishing predictable outcomes and a working relationship built on trust and accountability.

Commercial Terms, Risk Management, and Contract Alignment

Beyond technical capability and daily communication, commercial structure plays a critical role in long-term sourcing success. Clear commercial terms help engineering buyers manage financial risk, protect supply continuity, and avoid disputes once parts move into regular production. Misalignment at this stage often leads to friction, even when technical performance is strong.

Well-defined agreements set expectations on both sides. They clarify responsibilities, protect against unexpected changes, and create a framework for handling growth, revisions, and unforeseen disruptions in a controlled way.

Pricing Stability and Change Management

Initial pricing is rarely static over the life of a program. Material cost fluctuations, drawing revisions, and volume changes can all affect part pricing. Buyers should understand how suppliers manage these variables before committing to production.

Key areas to clarify include:

- Conditions under which pricing can change

- How material cost increases or decreases are handled

- Cost impact of engineering revisions or tolerance changes

Suppliers that communicate pricing drivers transparently reduce the risk of sudden cost increases and budget overruns.

Payment Terms and Financial Reliability

Payment structure affects cash flow on both sides of the relationship. Unrealistic payment terms can strain suppliers and indirectly affect delivery and quality performance.

Engineering buyers should assess:

- Standard payment terms and flexibility for long-term programs

- Supplier financial stability and dependency on short-term cash flow

- Willingness to align terms as volumes and trust increase

Financially stable suppliers are better positioned to invest in tooling, capacity, and process improvements that benefit long-term programs.

Risk Allocation and Contract Clarity

Contracts should clearly define how risks are shared and managed. Ambiguous terms often lead to disagreements when defects, delays, or external disruptions occur.

Effective contracts typically address:

- Responsibility for scrap and rework

- Ownership of tooling and fixtures

- Confidentiality and intellectual property protection

- Procedures for dispute resolution and escalation

For engineering buyers, contract clarity supports predictable outcomes and reinforces the supplier’s role as a committed manufacturing partner rather than a transactional vendor.

Conclusion

Selecting a CNC machining supplier is not a purchasing shortcut. It is a technical and strategic decision that directly affects part quality, cost control, delivery performance, and long-term production stability. Suppliers that look similar on paper can perform very differently once real parts, real tolerances, and real schedules are involved. Engineering buyers who rely only on price or stated capacity often absorb hidden costs later through rework, delays, and quality issues.

A disciplined evaluation of machine capability, material experience, quality systems, certifications, delivery reliability, transparency, and commercial alignment significantly reduces sourcing risk. The strongest suppliers go beyond machining to support engineering intent, provide early feedback, and scale responsibly as programs grow. Over time, these partnerships improve the total cost of ownership and create a more resilient manufacturing supply chain that supports both immediate production needs and long-term engineering goals.